Final

Expense

Final Expense Insurance helps ensure your family isn’t left with unexpected bills during a difficult time. From funeral and cremation costs to small debts and household expenses, this coverage offers an affordable way to leave behind security, not stress.

What is Final Expense Insurance?

Final Expense Insurance, sometimes called burial insurance or funeral insurance, is a type of whole life policy designed to cover end-of-life costs. Unlike larger life insurance plans, these policies are more affordable and accessible — giving families peace of mind without financial stress.

Key Features:

Affordable Coverage: Typically $2,000 - $50,000 in protection. Many policies start with modest death benefits, making final expense insurance accessible and budget-friendly for seniors.

Customizable Amounts: Choose coverage levels that align with your anticipated final expenses and personal preferences.

No Medical Exam Options: Most plans require no medical exam, only a few health questions which makes for easy qualifications.

Fixed Premiums: Premiums remain level throughout the life of the policy, helping with predictable budgeting.

Lifetime Coverage: Whole life policy that never expires as long as premiums are paid.

Coverage Can Help Pay For...

Funeral, burial, or cremation

Medical bills

Small debts or final household expenses

Leaving a small gift to family or a loved one

Coverage Options

Final Expense policies are flexible, allowing you to choose coverage that aligns with your needs and budget.

Coverage Options May Include:

Basic Policies - Smaller death benefits to handle funeral and burial only.

Expanded Policies – Larger coverage amounts to include medical bills, debts, or a gift to loved ones.

Customizable Plans – Select an amount that reflects your personal wishes and anticipated expenses.

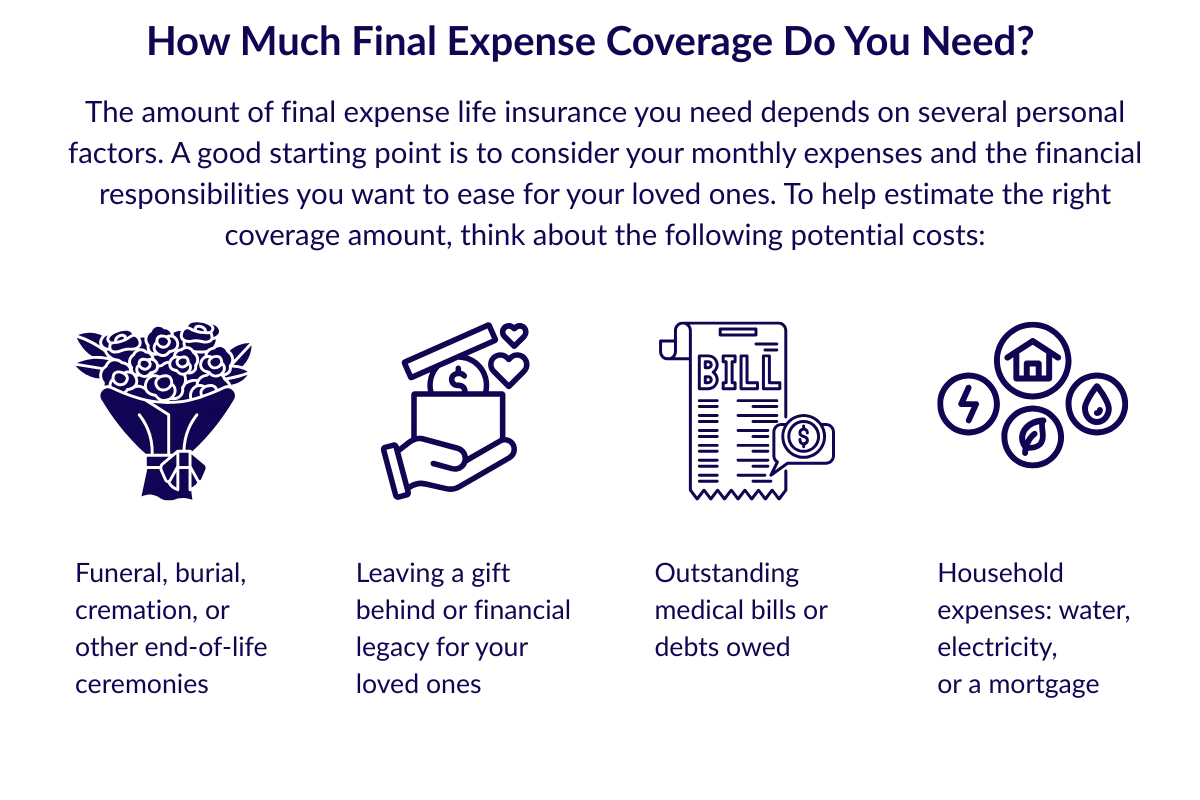

Tips for choosing the right coverage amount...

Estimate Funeral Costs: Consider whether you prefer a traditional burial or cremation, if you already own a burial plot, and the potential costs for a headstone or memorial service.

Plan for Inflation: Keep in mind that funeral and related expenses tend to increase over time, so it's wise to include a margin to accommodate future cost increases.

Factor in Personal Wishes: Decide if you want your coverage to solely handle final expenses or if you intend to leave a gift or small inheritance for your beneficiaries.

Account for Medical Bills and Outstanding Debt: Include any anticipated medical expenses or unpaid debts that should be covered by your policy to protect your loved ones from financial burdens.

Why Choose Final Expense Insurance?

Final expense insurance isn’t just about covering costs — it’s about protecting your family from unnecessary stress during a difficult time.

Peace of Mind: Loved ones can focus on honoring your life instead of worrying about expenses.

Affordable Protection: Designed to fit senior budgets.

Fast Payouts: Beneficiaries typically receive funds within just a few days.

No Financial Burden: Ensures your family isn’t left with unexpected bills.

👉 Take control today. Final expense insurance makes sure your wishes are honored and your loved ones are cared for. Speak with a licensed agent to explore your options and find the plan that’s right for you.

© AdviseCare Insurance 2026 All Rights Reserved. AdviseCare Insurance is not connected with or endorsed by the U.S. government or the Federal Medicare Program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. This information is for educational purposes only and is not intended to recommend or endorse any specific plan. Plan availability, benefits, premiums, copayments, and coinsurance amounts vary by carrier and location.